Systematic Investment Plans (SIPs) have emerged as a popular investment avenue for individuals seeking to achieve their long-term financial goals. SIPs offer a disciplined approach to investing by allowing individuals to invest a fixed amount regularly in mutual funds. However, determining the best type of SIP for Long-Term Investment requires a comprehensive understanding of various factors, including risk tolerance, investment horizon, and financial objectives.

Read more.. Navigating the Landscape of Used Car Loan Rates in India

Read more.. Navigating Car Financing with a Low CIBIL Score: Tips for Approval

Understanding Different Types of SIPs

1. Equity SIPs: Equity SIPs invest predominantly in stocks, making them ideal for long-term goals due to the potential for higher returns. However, they also come with higher risk and volatility. These SIPs are suitable for investors with a longer time horizon (typically over 5 years) who are comfortable with market fluctuations and seeking capital appreciation.

2. Debt SIPs: Debt SIPs invest in fixed-income securities like bonds and government securities. They are considered relatively safer compared to equity SIPs and are suitable for investors with a lower risk appetite. Debt SIPs are apt for those looking for stable but moderate returns over the long term.

3. Hybrid SIPs: Hybrid SIPs, also known as balanced SIPs, strike a balance between equity and debt. They offer diversification by investing in both asset classes. Hybrid SIPs are suitable for investors who want exposure to equities for potential growth while also mitigating risk through debt instruments. They are well-suited for medium- to long-term goals.

Read more.. Anticipation Builds as Adani Group Shares Gain Ahead

Read more.. Understanding Bullish and Bearish Trends in the Stock Market

Factors to Consider for Long-Term SIPs

1. Risk Tolerance: The level of risk an investor is comfortable with plays a pivotal role in choosing the right SIP. Investors willing to accept higher volatility for potentially higher returns might opt for equity SIPs. Those with a lower risk appetite might lean towards debt SIPs or hybrid SIPs.

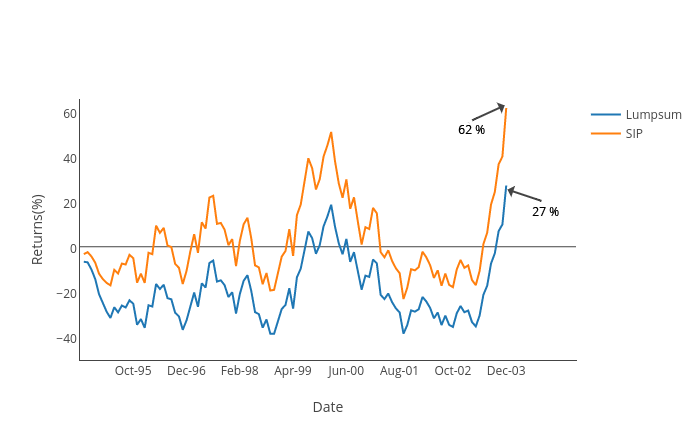

2. Investment Horizon: Long-term goals typically span over 5 years or more. Investors with longer horizons can afford to invest in equity SIPs as they have the potential to recover from market downturns and benefit from compounding over time.

3. Financial Goals: The nature of financial objectives, such as wealth accumulation, retirement planning, or purchasing a property, influences the choice of SIP. For goals that require substantial growth, equity SIPs might be more appropriate, while debt SIPs could suit goals with a focus on capital preservation.

4. Market Conditions: Market conditions and economic factors should be taken into account. During bullish markets, equity SIPs might perform well, but during bearish markets, they can experience significant fluctuations. Debt SIPs might provide stability during market downturns.

5. Diversification: Investing in a single SIP might not provide enough diversification. A combination of different SIP types can help mitigate risk and enhance overall portfolio stability.

Conclusion

Selecting the best type of SIP for long-term investment requires a thoughtful analysis of one’s risk tolerance, investment horizon, financial goals, and prevailing market conditions. There is no one-size-fits-all answer, as each investor’s circumstances are unique. Consulting with a financial advisor can provide personalized insights and help create a well-rounded investment strategy that aligns with long-term aspirations while managing risk effectively. Remember, the key to successful long-term investing is discipline, patience, and a clear understanding of the chosen investment avenue.

Read more.. How to calculate your net worth and why it matters.