In today’s fast-paced world, financial exigencies can arise without a moment’s notice. When faced with such situations, quick loans emerge as a savior, offering a swift influx of funds to tackle immediate needs. However, for many, the road to obtaining these quick loans might seem obstructed by the customary CIBIL check. Navigating this realm without the CIBIL factor necessitates a nuanced understanding and a strategic approach.

Read more.. Biometric Validation: Improving Security and Client Experience

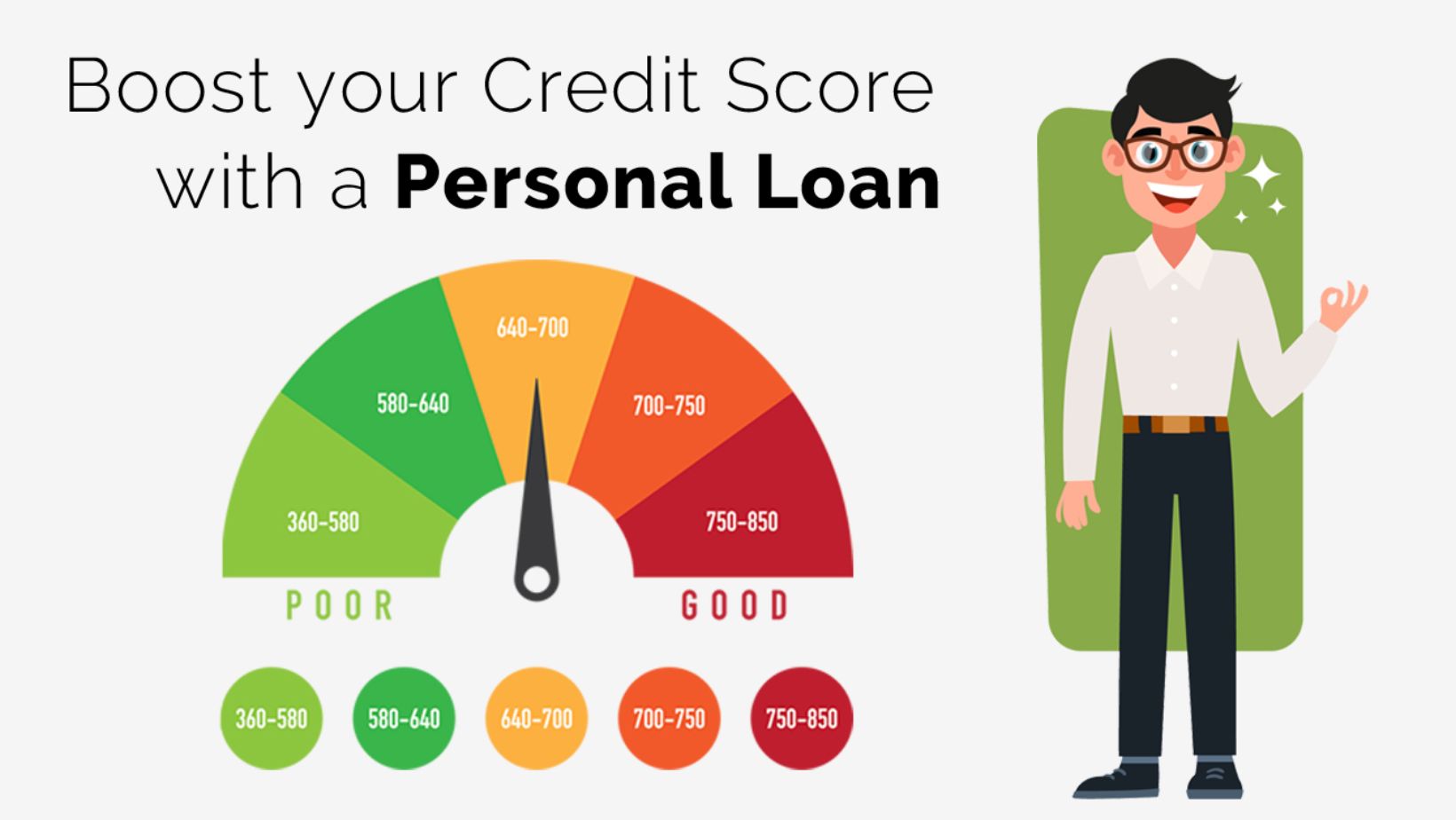

Quick loans, celebrated for their prompt approval and disbursal process, stand as a reliable solution during urgent times. Unlike traditional loans, these do not typically require an extensive credit history evaluation, making them accessible to a broader spectrum of individuals. The omission of a CIBIL check could appear advantageous for individuals with less-than-ideal credit histories or newcomers to the credit realm; nonetheless, this ease is accompanied by a distinct array of factors to contemplate.

Read more.. Expanded Reality and Augmented Reality: Opening New Elements of Involvement

Read more.. The Ascent of the Gig Economy: Potential open doors and Difficulties for Organizations

First and foremost, individuals venturing into the world of quick loans without CIBIL check should be cautious of the potential trade-offs. Lenders might compensate for the lack of credit history assessment by imposing higher interest rates or stringent repayment terms. As a borrower, it becomes imperative to meticulously scrutinize the terms and conditions of such loans, ensuring that the associated costs align with your financial capacity.

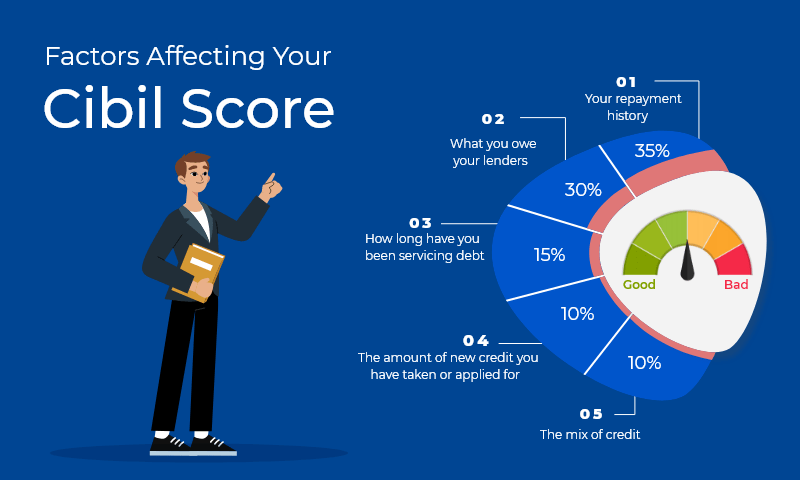

Responsible borrowing remains a cornerstone, regardless of the absence of a CIBIL check. It’s crucial to accurately assess your financial needs and borrow only what is absolutely necessary. While the allure of quickly obtaining additional funds is undeniable, yielding to this temptation and borrowing excessively can ensnare you in an inescapable loop of debt, making it an arduous task to regain financial freedom; furthermore, establishing a robust and well-thought-out repayment strategy is an absolute necessity. Understanding the terms, knowing the repayment schedule, and setting aside funds accordingly can prevent any unwelcome surprises down the line.

Read more.. Outfitting the Force of Information: Using Investigation for Informed Business Independent Direction

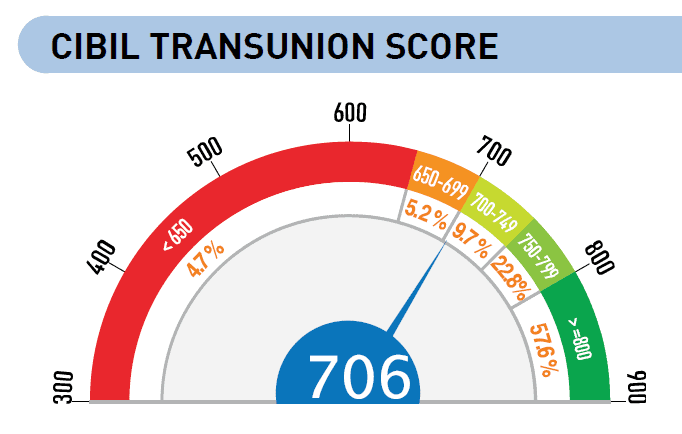

In the absence of a CIBIL check, lenders might rely on alternative means to evaluate a borrower’s creditworthiness. Employment history, income stability, and existing financial commitments could come under scrutiny. As a borrower, being prepared with documentation that supports your ability to repay the loan can enhance your chances of approval and favorable terms.

It’s worth noting that while quick loans without CIBIL checks offer a feasible option, they might not always be the most cost-effective one. Exploring other avenues, such as borrowing from friends or family, or even considering credit unions, could present more favorable terms, given the absence of intermediary fees or high-interest rates.

In conclusion, navigating the world of quick loans without CIBIL check demands a balanced approach. While the absence of credit history assessment might appear advantageous, borrowers must remain vigilant about the potential costs and obligations attached to such loans. Responsible borrowing, thorough research, and a clear repayment strategy are your allies in ensuring that swift financial assistance doesn’t pave the way for long-term financial challenges.