In the hustle and bustle of today’s world, financial crises have a way of catching you off guard. Be it an unforeseen medical expense, a sudden car repair, or just managing your finances until the next paycheck, easy money loans can offer a much-needed lifeline. This article aims to guide you through the landscape of easy money loans in 2023 and help you prepare for the financial terrain of 2024. Making informed decisions is paramount to safeguarding your financial stability.

Read more.. How to Take Money loans for Persnol use in Navratri

Read more.. How to take money loans on Navratri in 2023

Understanding Easy Money Loans

Easy money loans, commonly known as payday loans or cash advances, serve as short-term, unsecured financial aids tailored to offer swift cash access during urgent situations. Typically of modest amounts, they carry a high-interest burden, making prudent usage essential.

Read more.. The Power of Understanding Your CIBIL Score

1. Research Lenders

In 2023 and beyond, the financial landscape is continually evolving. Numerous lenders offer easy money loans, both online and in physical locations. Start by researching reputable lenders with transparent terms and conditions. Look for customer reviews and ratings to gauge their credibility.

2. Check the Regulations

Laws surrounding easy money loans vary from one place to another. Some jurisdictions have strict regulations in place to protect borrowers, while others may have fewer restrictions. Be aware of the rules in your area to ensure you’re dealing with a lender who operates within legal boundaries.

3. Assess Your Needs

Before applying for an easy money loan, evaluate your financial situation. Carefully assess your true borrowing needs and financial capacity to avoid overextending yourself, as excessive borrowing can trap you in a cycle of debt due to high-interest rates.

4. Understand the Terms

Thoroughly read and understand the terms of the loan. Pay attention to the interest rate, repayment schedule, and any additional fees. Clarify any doubts with the lender before signing the agreement.

5. Explore Alternatives

Consider alternative options before opting for an easy money loan. These may include borrowing from friends or family, seeking financial assistance programs, or negotiating with creditors. Exhaust all other possibilities before committing to a payday loan.

6. Budget for Repayment

Plan how you will repay the loan. To ensure financial stability, it is crucial to create a budget that designates a specific portion of your income for meeting loan repayment obligations, as failure to do so may lead to mounting interest charges and additional fees over time.

2024 and Beyond

As we look ahead to 2024, it’s clear that the financial industry will continue to evolve. New lending technologies and regulations may impact the landscape of easy money loans. Here are some tips to prepare for the year ahead:

1. Stay Informed: Keep yourself updated on changes in lending regulations and technologies. This knowledge will help you make more informed choices.

2. Emergency Fund: Consider building an emergency fund to reduce your reliance on easy money loans. Having savings to cover unexpected expenses is a smart financial move.

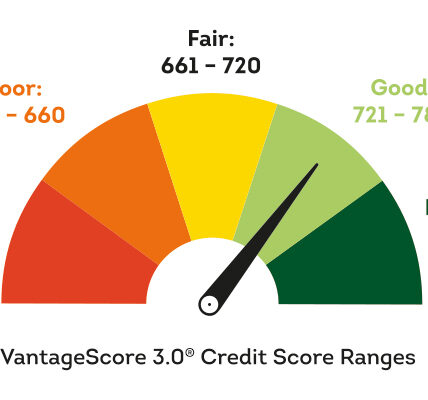

3. Explore Credit Options: If you have a good credit history, explore traditional lending options like personal loans or credit cards with lower interest rates.

4. Financial Education: Invest in improving your financial literacy.

Conclusion

To navigate the world of easy money loans in 2023 and beyond, research lenders, understand the terms, and explore alternatives. As we move into 2024, staying informed and making responsible financial decisions will be more crucial than ever. Remember, your financial well-being is worth the effort of making wise choices.